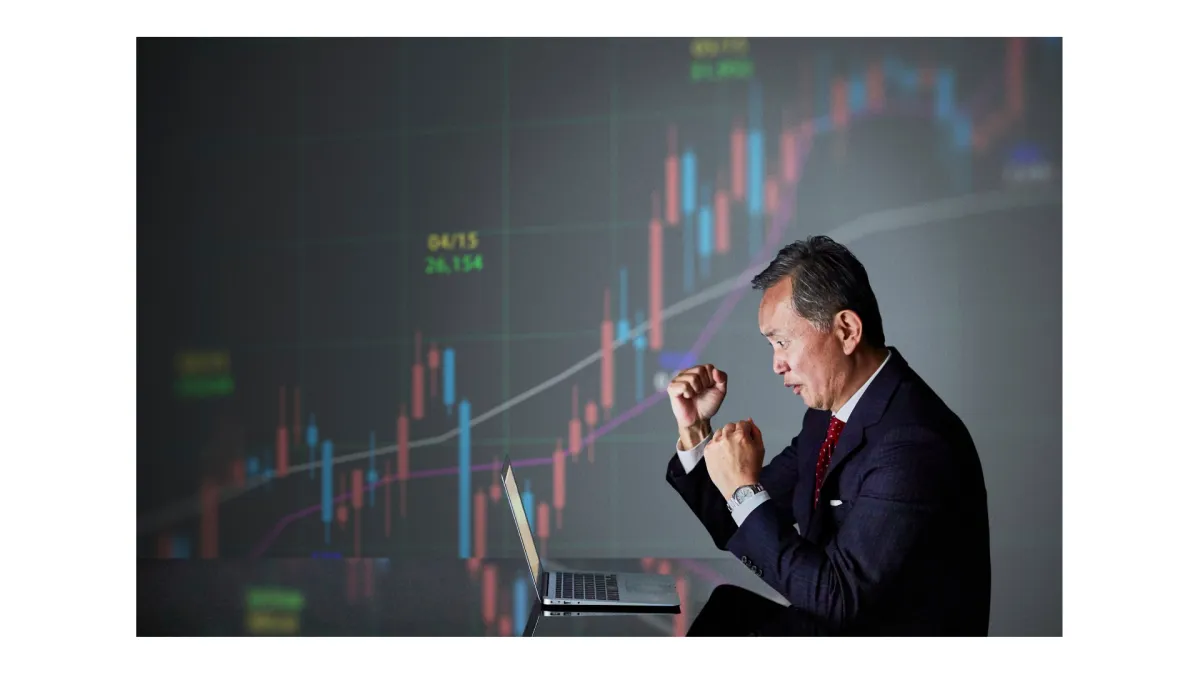

Own The Next Cycle

We invest in cash-flowing middle-market businesses and institutional-grade real estate to deliver durable income and asymmetric upside.

Investing in today's markets requires both vision and discipline. M&A delivers accelerated growth through strategic acquisitions. Real Estate delivers cash flow and stability through hard assets. Together, they provide a diversified path toward performance.

A Diversified Platform Built for Every Cycle

Why Diversification

M&A + Real Estate smooth volatility and compound returns

What Investors Gain

Priority allocations, co-invests, and quarterly briefings

Proof Points

Disciplined underwriting and aligned capital.

M&A Fund

Acquire resilient service businesses with stable cash flows and operating levers for value creation. Focus: disciplined underwriting, margin expansion, and scalable systems.

Real Estate Fund

Target Multifamily, Student Housing, Adult Assisted Living/Senior Living, and Hospitality. Thesis: cash flow first, value-add second—buy right, improve operations, de-risk.

Sourcing Edge

Under-followed opportunities via direct outreach, operator networks, and data-driven screening.

Operational Uplift

Pricing, cost structure, staffing, marketing, and tech—hands-on improvement to unlock EBITDA and NOI.

Disciplined Capital

Responsible leverage, scenario planning, and preservation-first structures to manage downside.

Institutional Reporting

Transparent dashboards, quarterly updates, and professional governance.

Why Now

Dislocation and tighter credit create buyer advantages for well-capitalized operators. We lean into mispricing, complexity, and forced sellers—combining patient capital with operating discipline.

How It Works

Qualify

Verify accreditation and align on objectives.

Allocate

Choose M&A, Real Estate, or both; review offering docs and subscribe.

Track & Grow

Receive updates, K-1s, and co-invest opportunities where applicable.

Ready to invest with GE360?

Get In Touch

Assistance Hours

Mon – Fri 9:00am – 5:00pm

Saturday & Sunday – CLOSED

Phone Number:

470-997-7577

Office: 400 Galleria Parkway Atlanta, GA 30339

Call 470-997-7577

Email:[email protected]

Site: www.globalequity360.com